Compliance beyond the box

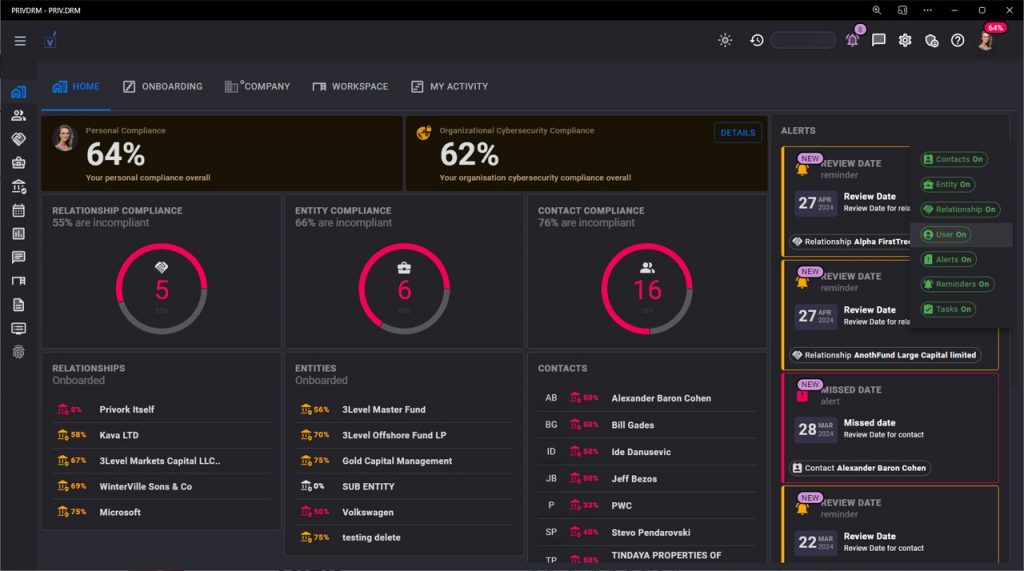

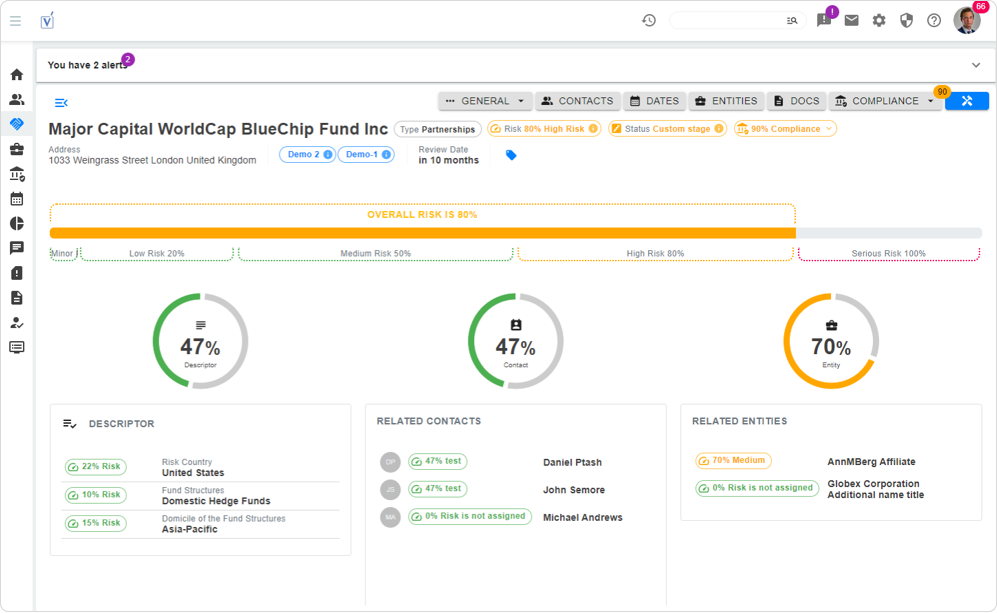

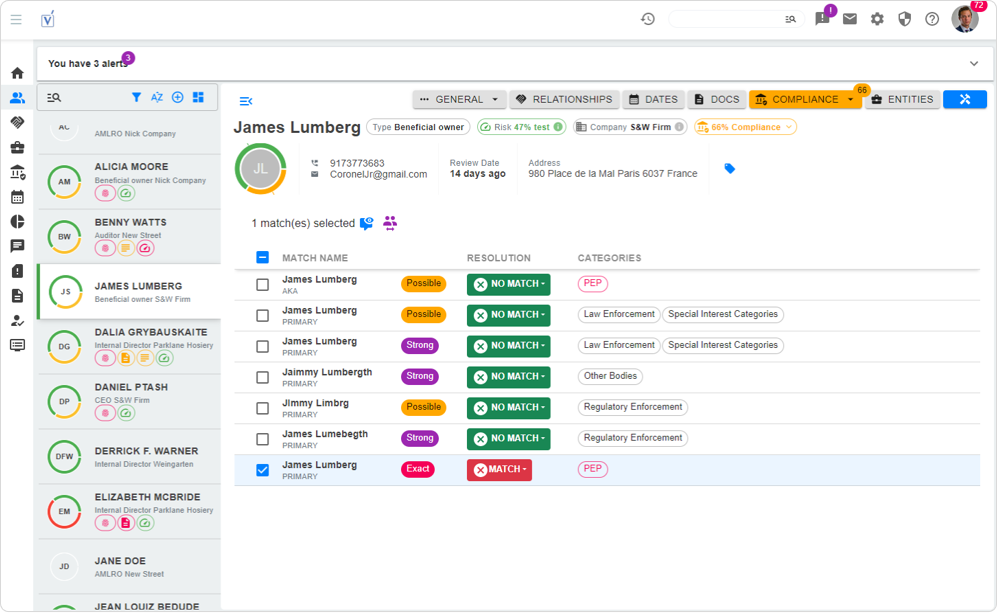

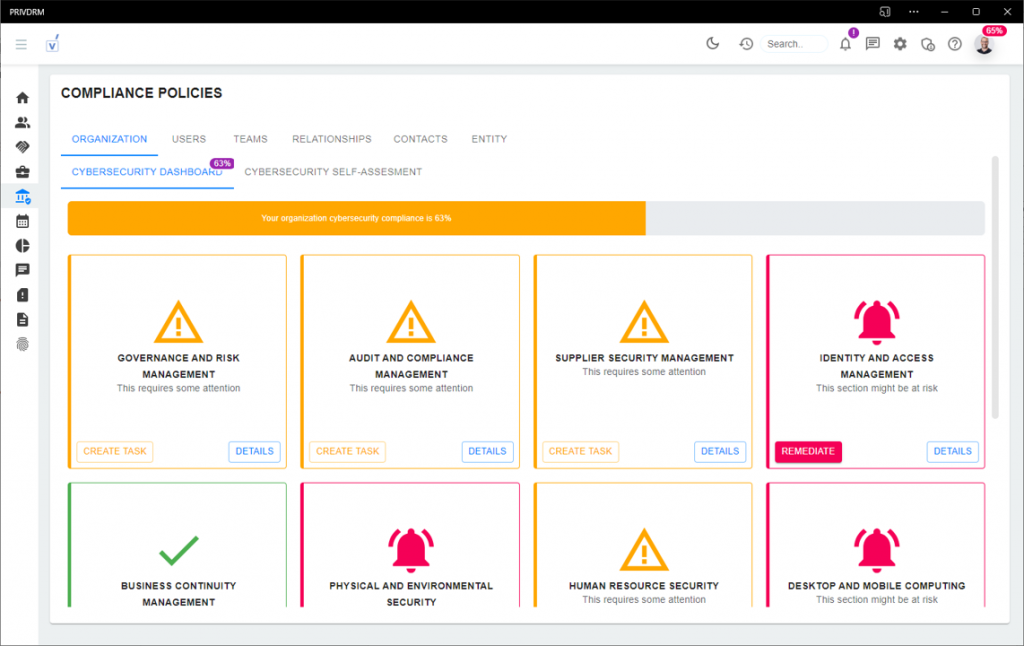

Privork’s platform is built to simplify entity governance, KYC-KYB, risk management, cybersecurity compliance and other regulatory requirements. We offer next-gen technology that has the flexibility to meet today’s complex regulatory compliance requirements and adapt to future challenges.